Here is Christine Lagarde's warning:

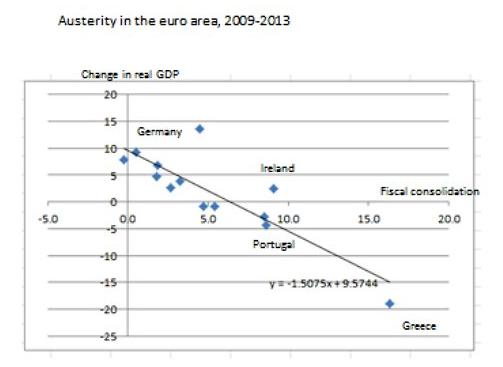

Christine Lagarde has urged countries to put a brake on austerity measures amid signs that the IMF is becoming increasingly concerned about the impact of government cutbacks on growth. Ms Lagarde, IMF managing director, cautioned against countries front-loading spending cuts and tax increases. “It’s sometimes better to have a bit more time,” she said at the annual meetings of the IMF and the World Bank on Thursday.Lagarde gets it, which should give pause to those who blame this crisis on "neoliberalism." If there were such a thing as a neoliberal consensus, the IMF would have to be part of it. But the IMF has gone off in a different direction under the leadership of Lagarde. The WEO contained this graph, which has now been widely reproduced in the blogosphere:

The fund warned earlier this week that governments around the world had systematically underestimated the damage done to growth by austerity.

Paul Krugman explains:

I and others have been arguing for a while that the experience of austerity in the eurozone clearly suggests pretty big Keynesian effects. Here, for example, is what a scatterplot of fiscal consolidation (from the IMF Fiscal Monitor) and growth (including an estimate for next year, from the World Economic Outlook) looks like.

But, you might object, maybe the causation runs the other way; maybe countries in trouble are forced into fiscal consolidation, so it’s not the austerity what did it. But the IMF has an answer to that: it looks at forecast errors versus austerity. Part of the reason for doing this is to figure out why things are going so much worse than expected; but there’s also the fact that the forecasts already included the known problems of the economies in question, so that you’re more or less getting an estimate of the impact of austerity over and above the known problems (and the initially assumed effect of austerity, which was supposed to be small).Here, "IMF" really means IMF chief economist Olivier Blanchard and economist Daniel Leigh, the authors of "Box 1.1" in the WEO (which can be downloaded here). They argue that the "multiplier" in the world's deleveraging economies is much larger than previously thought, indeed greater than one. Hence fiscal expansion adds more than €1 to GDP for every additional euro of government spending and subtracts more than €1 for every euro slashed by zealous budget cutters. This could make the goal of returning to equilibrium an infinite regress: for every step governments think they are taking toward it, the goal actually recedes by a greater distance. That is why Christine Lagarde is warning of the dangers of a downward spiral into depression. The risk is not negligible, but political systems throughout the developed world seem absolutely incapable of recognizing it. Instead, we slouch toward serfdom.

No comments:

Post a Comment